Reduced Burden | Reliable Income | Liquid Assets

Overview of REITs

Unlocking the Power of Real Estate: A Simplified Guide to REIT Investments

Overview of REITs

A Real Estate Investment Trust (REIT) offers a unique corporate structure that universalizes real estate investment, making it accessible to a broader range of investors. REITs provide substantial tax benefits, enabling retail investors to participate in commercial real estate’s income-generating and wealth-building opportunities without purchasing entire properties.

To qualify as a REIT, a company must:

- Generate at least 75% of its income from real estate-related activities.

- Hold at least 75% of its total assets in real estate.

- Have a minimum of 100 shareholders.

- Ensure no more than five individuals or entities collectively own over 50% of the shares.

- Distribute at least 90% of its taxable income to shareholders annually as dividends.

Meeting these criteria allows a REIT to operate as a “pass-through”entity, exempt from corporate income taxes. This leads to higher cash flow, which is distributed to investors as dividends, enhancing shareholder value. REIT dividends are taxed as ordinary income at the individual level, avoiding the double taxation applied to corporate dividends.

Three Types of REITs

REITs are classified into three categories based on their public or private status and whether they are traded on public exchanges

Publicly Traded REITs

Listed on major exchanges like the NYSE or NASDAQ, these REITs offer high liquidity and ease of trading. They follow strict regulatory standards, ensuring solid financial reporting. Share prices fluctuate with market demand and portfolio performance.

Private REITs

Offered through private placements to accredited investors, these REITs are not traded publicly. They require higher minimum investments and have less regulatory oversight, resulting in limited liquidity. Typically, they focus on specialized real estate sectors.

Public Non-Traded REITs

Registered with the SEC but not exchange-listed, these REITs are sold via brokers or directly by sponsors. They provide diversification and income but come with higher fees and limited liquidity, making capital access challenging until planned liquidity events.

Pros and Cons of REIT Types

Each type of REIT—public traded, private, and public non-traded—comes with its own benefits and drawbacks.Investors should evaluate their investment goals, risk appetite, and liquidity requirements carefully when selecting theREIT structure that best suits their needs.

- Highly liquid that you can sell – you can sell at any time the market is open

- Easily accessible to investors of all types – all you need is a brokerage account

- SEC regulatory oversight reduces risk for individual investors – financial reports and filings are publicly available

- May offer higher-return prospects compared to public markets -investors in private REITs frequently accept a higher debt level than those in public REITs

- More susceptible to volatility compared to other investment options —volatility like any other stock

- Prone to market valuation fluctuations similar to other equities —share prices can trade below the REITs underlying Net Asset Value (NAV)

- Absence of a mandated holding period can lead to selling at a loss during market downturns — shares can trade below intrinsic value in times of market stress

- The accredited investor requirement restricts accessibility for the majority of individuals – real estate is not for all

- Long-term holding encourages management to concentrate on strategic long-term goals – reducing emphasis on short-term quarterly results

- Reduced regulatory oversight results in lower operating costs, potentially boosting returns – the compliance expenses associated with being a publicly traded REIT may only become justified once the REIT has reached a sufficient scale

- May provide access to potentially higher-quality investments – often backed by real estate private equity firms such as Blackstone

- High minimum investment criteria further narrows the potential investment base — higher barriers to entry relative to publicly traded REITs

- A limited or nonexistent redemption plan can hinder or prevent selling opportunities — sponsor can also restrict redemptions

- Minimum investment thresholds

- Required submission of financial disclosures, including audited annual reports, to the SEC, coupled with state regulatory oversight – publicly available financial information similar to publicly traded REITs

- The lack of public trading and a focus on long-term holding allows management to prioritize strategic, long-term planning – the transparency of a publicly traded REIT with the long term focus of a private REIT

- Brokerage fees and commissions — similar fees to a private REIT

- Mandatory holding periods that may not align with individual investor’s objectives — sponsor can also restrict redemptions

Public Traded REIT Shares vs. OP Units

Publicly traded REIT shares represent equity ownership in a publicly traded Real Estate Investment Trust. These shares are traded on major stock exchanges, providing high liquidity and flexibility for investors. However, publicly traded REIT shares can be subject to market volatility influenced by broader economic factors and interest rates.

In contrast, REIT OP units are equity interests in the operating partnership controlled by the REIT. When acquiring a property, a REIT may issue OP units instead of cash or REIT shares. These OP units can often be converted into REIT shares after a certain period, usually on a one-to-one basis. A key advantage of OP units is the potential for tax deferral, allowing property owners to defer capital gains taxes until they convert the units into REIT shares. OP unitholders’ interests are aligned with the REIT’s management and shareholders, sharing in profits and losses, and they have the flexibility to decide when to realize potential gains.

- A Public REIT share represents ownership in a REIT as a traditional equity ownership stake

- Investors purchase publicly traded REIT shares on stock exchanges, just like they would buy shares of any publicly traded company

- Public Traded REIT shares typically entitle the shareholder to dividends and voting rights in proportion to their ownership stake

- Public Traded REIT shares are commonly traded on public stock exchanges and are subject to market fluctuations

- A REIT OP (Operating Partnership) unit represents ownership in a REIT through an operating partnership structure

- Investors acquire REIT OP units through contribution of their real estate assets to the REIT in exchange for OP units

- REIT OP units often provide similar economic benefits to REIT shares, such as distributions and potential appreciation in value

- However, REIT OP units may have different tax implications and voting rights compared to REIT shares

- REIT OP units are typically utilized in UPREIT (Umbrella Partnership Real Estate Investment Trust) structures, where real estate assets are contributed to an operating partnership controlled by the REIT

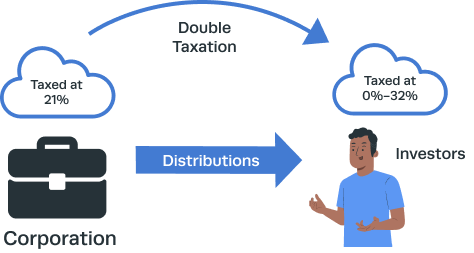

Corporations Face Double Taxation ...

Corporations face double taxation, meaning their earnings are taxed twice. First, the corporation pays corporate income tax on its profits. Then, when these after-tax profits are distributed to shareholders as dividends, the shareholders also pay taxes on this income at their individual tax rates. This results in the same earnings being taxed once at the corporate level and again at the individual level, effectively reducing the net returns for shareholders.

By understanding the implications of double taxation, investors can make more informed decisions about their investments. For instance, they might consider alternative structures, such as pass-through entities like S corporations or limited liability companies (LLCs), which do not face the same level of tax burden. Additionally, strategies such as retaining earnings within the corporation or reinvesting profits can also help mitigate the impact of double taxation.

... While REITs Benefit from Single Taxation.

REITs benefit from single taxation, unlike corporations that face double taxation. In a REIT, profits are passed directly to shareholders and taxed only at the individual level, bypassing corporate income tax. This structure avoids the double taxation issue, where corporate profits are taxed first at the corporate level and again as dividends at the individual level.

Consequently, REIT can offer more efficient returns to investors by eliminating the additional tax layer.

Taxation of REIT Dividends and Distributions

Dividends and distributions from Real Estate Investment Trusts (REITs) are taxed at the individual level based on the income type:

Ordinary Income Dividends

Most REIT dividends are taxed as ordinary income, derived from rental earnings minus expenses. These dividends are taxed at the investor’s marginal tax rate (10% to 37%).

Capital Gain Dividends

When REITs sell property at a profit, the distributed gains are taxed at capital gains rates (0%, 15%, or 20%), depending on the investor’s income.

Return of Capital

Some dividends are classified as a return of capital, reducing the shareholder’s cost basis in the REIT shares and deferring taxes until the shares are sold.

While REIT dividends don’t qualify for reduced tax rates on qualified dividends, they avoid double taxation since REITs are exempt from corporate taxes.

Taxation of REIT Dividends vs. REIT OP Unit Distributions

REIT Dividends:

- Reported on Form 1099-DIV

- Categorized as ordinary income, capital gains distributions, and return of capital

- Most dividends are taxed as ordinary income at the investor’s regular income tax rate

- Capital gains from property sales are taxed at capital gains rates

- Return of capital reduces the investor’s cost basis and defers taxes until sale

REIT OP Unit Distributions:

- Detailed in Schedule K-1, involving complex partnership accounting

- Ordinary income taxed at the investor’s income tax rate

- Capital gains taxed at capital gains rates, as reported on K-1

- Return of capital reduces investor’s cost basis and defers taxes until units are sold or converted

- Potential for unrelated business taxable income (UBTI), affecting tax-exempt investors

Form 1099-DN, which categorizes ordinary income, capital gains, and return of capital.

Schedule K-1, detailing each type of income, gains, losses, and deductions at the partnership level.

Taxed at the individual’s ordinary income tax rate. Often the bulk of the distribution.

Taxed as ordinary income per partnership allocations, which might vary based on partnership agreements.

Distributed capital gains are taxed at the capital gains tax rates.

Capital gains passed through to partners and taxed at individual capital gains tax rates.

Reduces the cost basis of the REIT shares, deferring taxes until shares are sold.

Reduces the cost bees of the OP units, affecting capital gains taxes when units are sold or converted.

Rare in typical REIT- operations; dMdends generally not subject to UBTI.

More likely to generate UBTI. especially if the REIT engages in non-standard real estate business activities using leverage.

Not directly visible to shareholders but reduces taxable income distributed as dividends.

Clearly shown on K-1 forms; directly reduces taxable income allocated to partners and adjusts their basis.

REIT- shares are static and do not convert into other securities within the REIT- structure.

OP units may often be converted into REF shares; conversion is typically a non-taxable event, but subsequent sales are taxed based on original OP unit basis.

Limited mainly to decisions about timing of buying/selling shares.

Provides significant flexibility due to partnership attributes, potentially affecting at-risk rules, passive activity losses, and specific allocations.

Simplified tax filing with dividends clearly reported on Form 1099-DIV.

More complex due to Schedule K-1, which may require additional tax planning and potentially more complex tax filings.

Must distribute at least 90% of taxable income to maintain REIT status, affecting dividend types and amounts.

Must adhere to the same REIT distribution requirements, but allocations can be adjusted within the partnership to optimize tax outcomes for partners.

Generally predictable based on dividend types reported.

Can vary significantly based on partnership structure, individual allocations, and specific deductions like depreciation.

Medalist REIT Cheat Sheet

We created a REIT Quick Reference as a quick reference to help you understand the characteristics of various types of REITs. Whether your priority is liquidity, leverage levels, or low volatility, this cheat sheet provides the essential information you need to make informed investment decisions.